If you are in your 20’s, you are definitely going through that phase of life when you can expect the most changes to happen. You have probably graduated from your college, may be planning to move into an apartment for the first time, and probably applying for your first job. This decade of your life is going to be the most exciting in all likeliness. Additionally, it’s an important time for you to make the correct lifestyle choices and to follow the right money saving rules for constructing a solid foundation for the decades ahead.

It’s Important To Choose A Frugal Lifestyle

If you are 20-something, thinking about money might not be one of your priorities. Chances are there that you strongly believe in the YOLO (‘You Only Live Once’) philosophy and making smart and wise money decisions is probably a secondary objective of your life right now. While you ought not to miss out on all the fun at this age, you should also be thinking about securing your future. Remember that the money decisions you make now will have a deep impact on your financial portfolio in the near future. If you are a millennial and you want to make the right lifestyle decisions to save for your "rainy day"fund, here are five golden money rules you should follow.

If you are 20-something, thinking about money might not be one of your priorities. Chances are there that you strongly believe in the YOLO (‘You Only Live Once’) philosophy and making smart and wise money decisions is probably a secondary objective of your life right now. While you ought not to miss out on all the fun at this age, you should also be thinking about securing your future. Remember that the money decisions you make now will have a deep impact on your financial portfolio in the near future. If you are a millennial and you want to make the right lifestyle decisions to save for your "rainy day"fund, here are five golden money rules you should follow.

Rule One: Spend Only As Much As You Can

No matter what age you are, the most important money rule you should live by is to cut your coat according to your cloth. Do not spend more than what you actually earn. Borrowing money for meeting certain lifestyle needs is easy, but paying off the borrowed money is quite challenging. To avoid insolvency at a young age, do not put yourself in that situation in the first place. Instead, choose a sustainable lifestyle so you never have to worry about paying off your debt.

No matter what age you are, the most important money rule you should live by is to cut your coat according to your cloth. Do not spend more than what you actually earn. Borrowing money for meeting certain lifestyle needs is easy, but paying off the borrowed money is quite challenging. To avoid insolvency at a young age, do not put yourself in that situation in the first place. Instead, choose a sustainable lifestyle so you never have to worry about paying off your debt.

Rule Two: Invest In An Emergency Fund

Life can become very unpredictable at times. You must prepare yourself well in advance for any sort of challenge that life might throw at you. A good way to stay prepared for the biggest challenges in life is to invest in an emergency fund. This way, you can have a buffer to recuperate from any sort of financial loss or damage. At the same time, you can meet your emergency needs with the money you have set aside. You don’t need to save too much for a rainy day. Just start small and try to set aside three months of expenses.

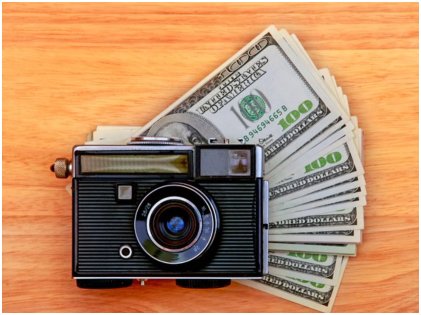

Rule Three: Monetize Your Passions

Getting that dream job in your early or mid-20s can be pretty difficult, but you can always try to explore your passions. It’s actually the best time of your life to explore how you can possibly turn your hobbies into a source of income. Explore what you are really passionate about. For example, if you love cooking, you can record your cooking sessions with a camcorder or something and start a YouTube channel to share your cooking tips with others. This way, you can gradually start earning from YouTube should you start picking up a following. There are hundreds of people out there who love their lifestyle and hobbies and hate having a day job. But these people are actually earning well by monetizing their passions.

Getting that dream job in your early or mid-20s can be pretty difficult, but you can always try to explore your passions. It’s actually the best time of your life to explore how you can possibly turn your hobbies into a source of income. Explore what you are really passionate about. For example, if you love cooking, you can record your cooking sessions with a camcorder or something and start a YouTube channel to share your cooking tips with others. This way, you can gradually start earning from YouTube should you start picking up a following. There are hundreds of people out there who love their lifestyle and hobbies and hate having a day job. But these people are actually earning well by monetizing their passions.

Rule Four: Start Saving For Your Retirement

Sounds crazy? Well, most millennials do not think about retirement as they just want to "live once", until some day when they suddenly discover that they are not able to work anymore, with little to no money left in their banks. The earlier you begin saving for retirement, the better it is. The more money you can sock away in your retirement accounts now, the better retirement you can expect in your old age. For a start, invest in a 401(K) plan.

Sounds crazy? Well, most millennials do not think about retirement as they just want to "live once", until some day when they suddenly discover that they are not able to work anymore, with little to no money left in their banks. The earlier you begin saving for retirement, the better it is. The more money you can sock away in your retirement accounts now, the better retirement you can expect in your old age. For a start, invest in a 401(K) plan.

Rule Five: Do Not Compare Yourself To Your Friends

This is not just a money rule, but it applies to all spheres of life. Stop comparing yourself to your friends. Social media often gives us a flawed and wrong perception of the harsh realities. You may think all of your friends are splurging on things, but the reality is quite different. Don’t let others influence your money and lifestyle decisions. Have all the fun but spend only as much as you can (See rule one).

If you want, you can even download money management apps to get started. Consulting a personal finance manager is not a bad idea either.